What you do not Know About Unfiled Tax Returns

A lot of misconceptions are often going around when it comes to unfiled tax returns and it is important to note that these misconceptions usually cost many people a lot at the end of the day if they follow them. One popular misconception is that one can file their taxes whenever they want which is often not the case since the tax authorities usually specify on a certain date which ought to be followed if people or rather the citizens of that country want to avoid penalties.

In short, it is vital for one to make sure that they file their taxes on time and at the same time, in the event when they realize that the dates that had been set by the tax authorities for one to file their taxes have passed, it is important for one to file their taxes as soon as they can. Keep in mind that it is very essential for one to file their taxes as soon as they can once they realize this since their timelines have passed and at the same time huge penalties may be imposed on them. Click here now.

You have an opportunity of avoiding huge penalties which are often imposed when one does not file their taxes on time when they do so as soon as they realize that they have not since it often takes times for the tax authorities to start haunting down people who have not filed their taxes. There may be cases where one may face criminal charges in the event when the tax authorities realize that you have not been filing your taxes for years or the court comes into the conclusion that you ought to face criminal charges. Therefore, it is a good decision for you to file your taxes as soon as possible regardless of how long you may have not been filing your taxes. Click here!

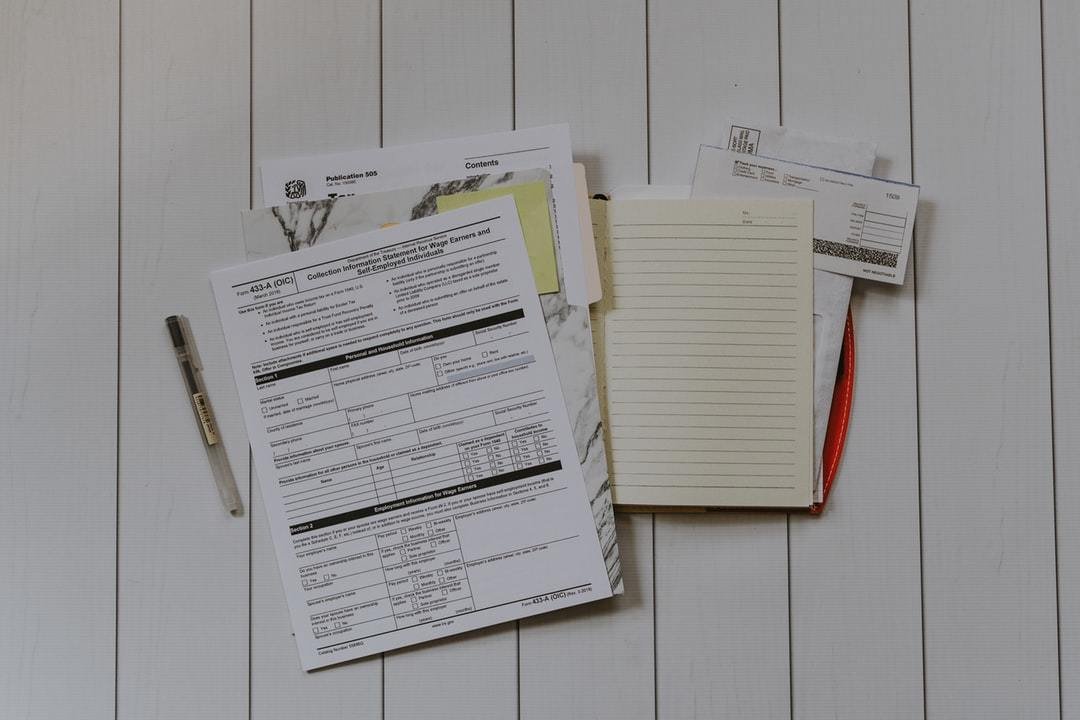

Once you come into a realization that you have unfiled taxes ensure you have all the documents that are usually required when one is filling their taxes, for example, your receipts for deductions and even your W-2’s. In some situations, it may be impossible for one not to find their documents especially it has been years since they last filed their taxes and, in some cases, one should contact the tax authorities to assist him or her. You will come to realize that it was a good decision for you to turn to the tax authorities if you do have the necessary documents due to the fact that they may give you other tax returns to file. The likelihood of you avoiding penalties will be high and, in some cases, you may receive credit.

See more here: https://youtu.be/zVdvf5q-w2A.